Strategic support in business sales, acquisitions, and fundraising for SMEs

Comprehensive management of the transaction process

Sale, acquisition, and fundraising operations are complex and time-consuming. We manage the entire process, including :

- Business evaluation and valuation

- Preparation of the presentation memorandum

- Search and selection of counterparties

- Negotiation of transaction terms

- Coordination of due diligence and closing

This end-to-end management allows business leaders to stay focused on the day-to-day operations of their company, ensuring continuity and growth throughout the transaction period.

Why choose Evaliance Capital ?

A dedicated partner for the sucess of your project

A rigorous method

Our mission is to secure and optimize every stage of your project. We prioritize in-depth strategic and financial analysis, customization tailored to your context, and discreet and efficient management of transactions through closing. The goal is to ensure the success of your strategic ambitions while reducing the risks associated with complex operations.

Recognized expertise

With over 35 years of experience in finance, capital markets, and strategic consulting, Evaliance Capital supports SME and microbusiness leaders in their sales, acquisitions, and fundraising operations. The firm is led by Eric BORIAS, an engineer and economist, former CFO and Treasurer of major banking groups, and president of a network of Business Angels for over 20 years.

A strategic network

Based in Paris, Evaliance Capital has both national and international reach. Its extensive network of contacts offers its clients privileged access to investors, as well as industrial and financial partners, creating unique opportunities. The firm’s commitment is based on confidential, rigorous, and fully customized support, in line with industry best practices.

Unique know-how serving business leaders

Thanks to his versatile background, Eric BORIAS has developed strong expertise in complex negotiations, the design of customized financial solutions, and the valuation of companies in contexts of transfer, growth, or restructuring.

This approach is enhanced by :

- In-depth sector knowledge of the markets,

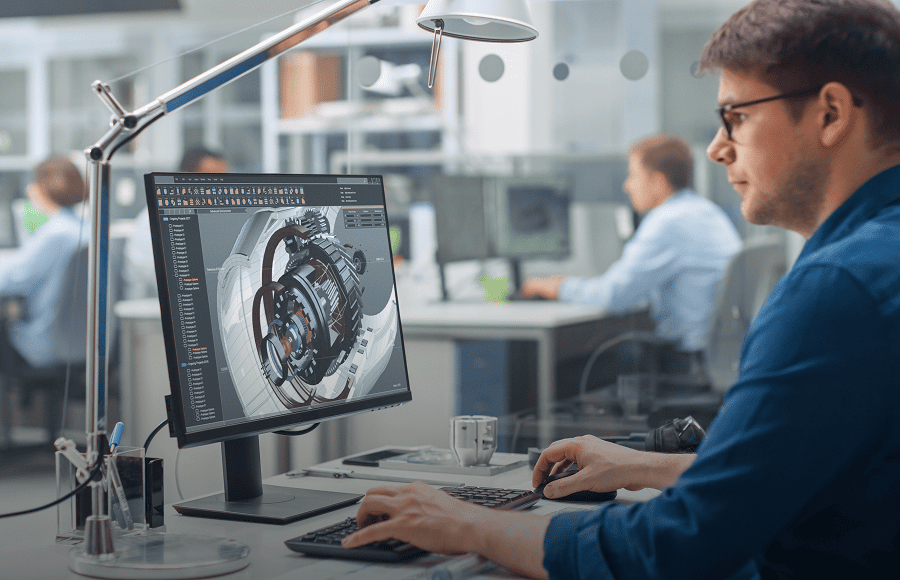

- Use of powerful analytical tools,

- An ability to structure complex deals while safeguarding the interests of business leaders.