Experts in sales, acquisitions, fundraising, and valuation.

What is your project ?

Our services

Business sale

The sale of a business is a major milestone in the life of a business leader.

Careful preparation is essential to ensure that it goes smoothly.

Business acquisition

Whether your goal is to expand your geographic presence, diversify your activities, or strengthen your market position, acquiring a competing company can be an effective solution.

Fundraising

A strategic step in accelerating the growth of your business, fundraising requires careful preparation and a thorough understanding of financial mechanisms.

Business valuation

Whether you are considering a sale, acquisition, or merger, the success of your transaction depends on one fundamental step : business valuation, also known as valuation.

Strategic Support in Business Sales, Acquisitions, and Fundraising for SMEs

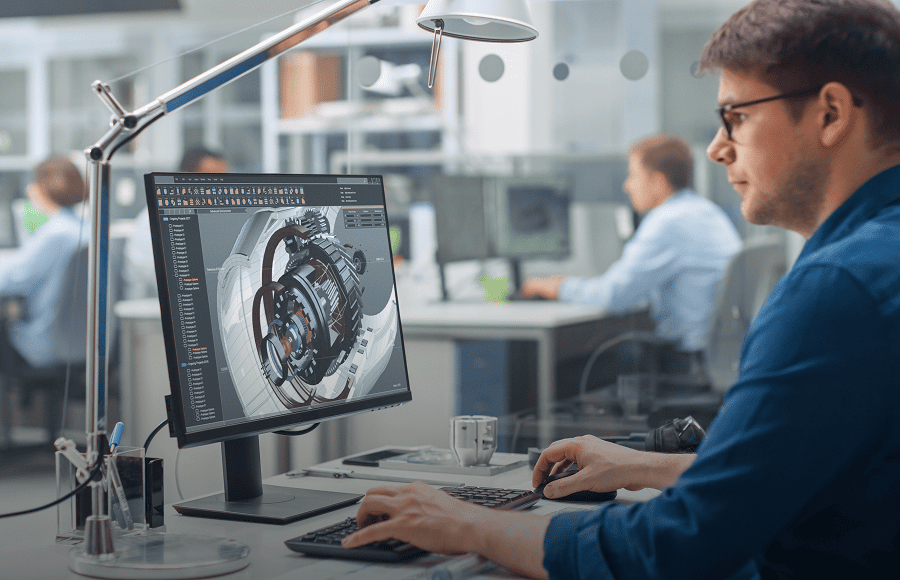

Evaliance Capital supports small and medium-sized enterprises (SMEs) across all sectors in their sale, acquisition, or fundraising projects. With our expertise in mergers and acquisitions (M&A), we offer tailor-made solutions at every stage of the transaction process.

This end-to-end management allows business leaders to stay focused on the day-to-day operations of their company, ensuring continuity and growth throughout the transaction period.

The firm is led by Eric BORIAS, an engineer and economist with more than 35 years of experience in financial management, capital markets, and strategic consulting. His career includes senior positions such as Chief Financial Officer and Treasurer in several leading banking groups.

Why choose Evaliance Capital ?

A tailored, results-oriented approach

A rigorous methodology serving your objectives

Our approach is based on in-depth strategic and financial analysis, customized solutions tailored to the sector and human context, and discreet and efficient management of operations through to closing.

Operational Expertise Proven by Results

With 5 to 10 sales or acquisitions completed each year, Evaliance Capital has demonstrated its ability to close complex deals in a demanding environment.

Success-based compensation model

Our services are based on a clear remuneration model aligned with your results : success fees calculated as a percentage of the transaction amount, or according to an agreed flat fee.

Who is Evaliance Capital for ?

Evaliance Capital supports business sale and acquisition projects for companies with revenues generally ranging from €2 million to €20 million, working alongside both corporate sellers and buyers. Backed by a network of seasoned experts, Evaliance Capital implements a structured, tailor-made, and results-driven approach.

Based in Paris, Evaliance Capital benefits from an extensive network across France and internationally, providing its clients with unique opportunities and privileged access to investors, industrial or financial partners.

Some figures

35+years old

Experience in financial management, capital markets, and strategic consulting

5 to 10

Number of sales and acquisitions completed each year

€2 to €20 million

Revenue of companies whose sale or acquisition is supported by Evaliance Capital

Latest articles

Why should an executive consult a wealth management advisor after selling their business ?

Après la cession d’une entreprise, consulter un conseiller en gestion patrimoniale est essentiel pour sécuriser le capital, optimiser la fiscalité et diversifier intelligemment les placements. Il accompagne aussi la structuration du patrimoine, la préparation de la transmission familiale et la protection des proches. Ce soutien expert transforme un capital en projet de vie durable et serein.

Why should an executive consult a wealth management advisor after selling their business ?

After selling a business, consulting a wealth management advisor is essential to secure capital, optimize taxation, and diversify investments intelligently. They also assist with wealth structuring, preparing for family succession, and protecting loved ones. This expert support transforms capital into a sustainable and peaceful life plan.

Succeeding in the post-acquisition period : staying on course for smooth integration

The success of an acquisition doesn't end with the signing : post-acquisition integration is decisive. It relies on a strategic vision, transparent communication, careful management of corporate cultures, and the retention of key talent. Monitored by appropriate indicators and fueled by innovation, this phase transforms the transition into an opportunity for sustainable growth and a truly collective project.